I remember the exact moment the weight of the future really hit me. I was sitting at our old kitchen table, the wood worn smooth from years of family meals and homework sessions, staring at a college brochure. The glossy photos showed smiling students on manicured lawns, vibrant classrooms, and state-of-the-art labs. It looked like a dream, a world away from my quiet neighborhood. Then my eyes drifted to the bottom of the page, to the tiny print that detailed tuition fees. My heart sank, a heavy stone dropping into a cold well. It wasn’t just a dream; it felt like an impossible fantasy. My parents worked hard, but the numbers on that page were astronomical. How could someone like me, from a family with modest means, ever afford something like this? That moment was the beginning of my journey into the labyrinth of student financial aid.

For a long time, I thought "financial aid" was just a fancy term for "loans" – meaning debt, a big scary monster waiting to pounce after graduation. I imagined signing away my future, working for years just to pay off what felt like an insurmountable sum. But as I started digging, fueled by a stubborn hope that there had to be another way, I learned that student financial aid is so much more diverse and forgiving than I ever imagined. It’s not just one thing; it’s a whole collection of possibilities designed to bridge the gap between what you can afford and what college actually costs. It’s the lifeline that allowed me, and countless others, to even consider higher education.

Let me tell you about the different threads of this lifeline, because understanding them is the first step to grabbing hold.

First, there are grants. Oh, grants! These felt like finding buried treasure. Grants are often called "gift aid" because, unlike loans, you don’t have to pay them back. Imagine that – money given to you, simply because you qualify, to help pay for school. The most common one I learned about was the Federal Pell Grant, which is awarded based on financial need. I remember filling out the FAFSA – the Free Application for Federal Student Aid – for the first time. It was daunting, a long form asking for all sorts of family financial information. My mom and I sat together, cross-referencing tax documents and bank statements. It felt like an interrogation, but it was crucial. When the notification came that I qualified for a Pell Grant, a huge wave of relief washed over me. It wasn’t enough to cover everything, not by a long shot, but it was a substantial chunk, a clear sign that help was indeed out there. Besides Pell Grants, colleges themselves often offer their own institutional grants, and states have their programs too. Each grant had its own rules, but the core idea was always the same: money I didn’t have to repay.

Then came scholarships. If grants were buried treasure, scholarships were like scattered gold coins, some small, some large, hidden in plain sight but requiring a diligent search. This is where the real hunt began. Scholarships are also gift aid, but they’re typically awarded based on a wider range of criteria than just financial need. Some are merit-based, meaning they look at your grades, test scores, or extracurricular activities. Others are need-based, similar to grants. But there are also scholarships for just about everything under the sun: for specific majors, for students from certain ethnic backgrounds, for those with unique talents, for community service, even for being left-handed! I spent hours upon hours on scholarship search websites, in my high school guidance counselor’s office, and even at the local library, sifting through lists and application forms.

Each scholarship application felt like a mini-project. Some required essays, where I had to articulate my dreams, my challenges, and why I deserved the help. Others asked for letters of recommendation from teachers or mentors who knew my work ethic and character. There were times I felt like giving up, writing essay after essay, tailoring each one to a different prompt, knowing the odds were stacked against me. But then, a small envelope would arrive, or an email notification, telling me I’d won a $500 scholarship from a local rotary club, or a $1,000 scholarship from a foundation supporting students in my intended major. Each small victory fueled my resolve. These weren’t massive sums individually, but collectively, they began to add up, chipping away at that intimidating tuition figure. The process taught me persistence, how to articulate my story, and the value of asking for help.

Now, let’s talk about loans. This was the part that initially scared me the most, and for good reason. Loans are money you do have to pay back, usually with interest. But I learned that not all loans are created equal. The most favorable ones come from the federal government. Federal student loans, like Stafford Loans, often have lower, fixed interest rates and more flexible repayment options compared to private loans. Crucially, some federal loans are "subsidized," meaning the government pays the interest while you’re in school and during certain deferment periods. This was a game-changer for me. It meant the loan wouldn’t grow while I was still trying to earn my degree. Unsubsidized federal loans, on the other hand, start accruing interest immediately, but the interest can be deferred until after graduation.

I remember the day I had to sign the promissory note for my first federal student loan. My hand trembled slightly as I read through the terms and conditions. It felt like a significant commitment, a contract with my future self. My parents sat with me, explaining the importance of understanding what I was signing, the responsibility that came with it. We talked about budgeting, about living frugally in college, about only borrowing what was absolutely necessary. It was a serious decision, one I approached with caution, but it was also a necessary piece of the puzzle. Without that loan, even with grants and scholarships, I wouldn’t have been able to cover all my costs. It was a tool, not a trap, as long as I used it wisely.

Finally, there was work-study. This was an opportunity to earn money directly through a part-time job on campus, funded by the federal government. The jobs were usually designed to fit around a student’s academic schedule and were often related to their field of study or provided valuable transferable skills. I got a work-study job in the university library. My tasks included shelving books, helping students find resources, and occasionally assisting with events. It wasn’t glamorous, but it was incredibly rewarding. Not only did I earn money to cover my living expenses and reduce the amount I needed to borrow, but I also gained work experience, met new people, and felt more connected to the campus community. It taught me time management and the satisfaction of contributing. That small paycheck, earned through my own effort, felt incredibly valuable.

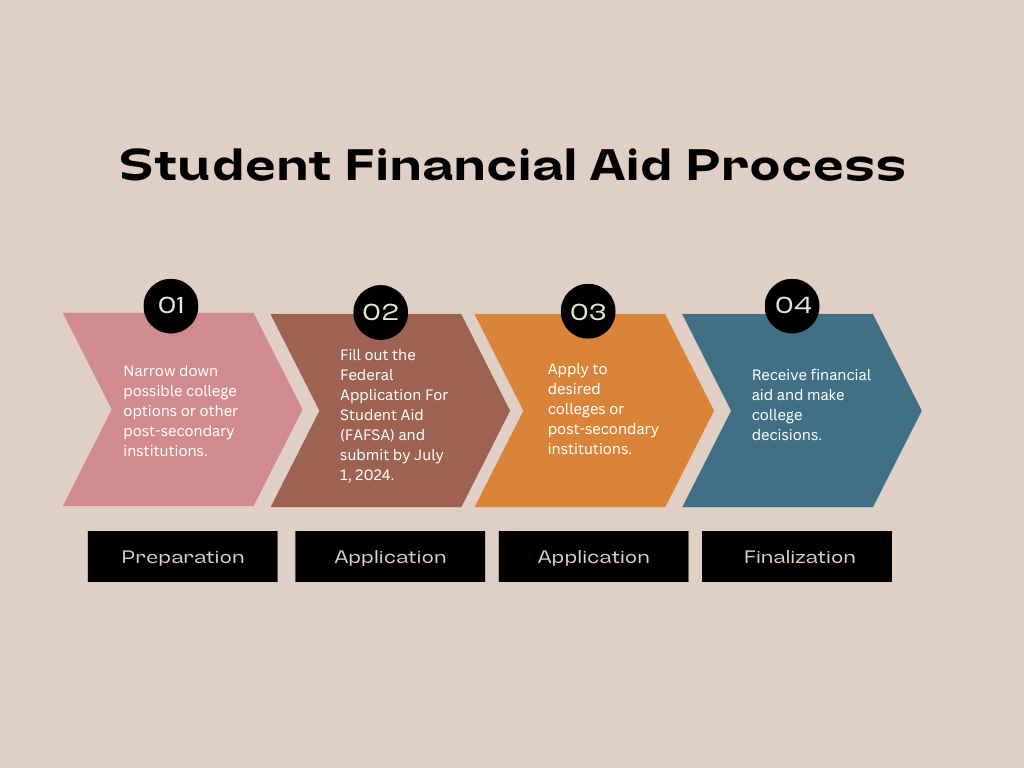

So, how do you even begin to untangle all of this? It all starts with the FAFSA. I can’t stress this enough: fill out the FAFSA every single year you plan to attend college. It’s the gateway to federal grants, federal loans, and even many institutional and state aid programs. The form gathers information about your family’s income, assets, and household size to determine your Expected Family Contribution (EFC). This EFC isn’t what your family will pay, but rather an index colleges use to calculate how much financial aid you might need. The earlier you submit it, the better, as some aid is awarded on a first-come, first-served basis. Don’t be afraid to ask for help with it; high school counselors, college financial aid offices, and even online resources are there to guide you through the process.

Beyond the FAFSA, some private colleges might also require the CSS Profile. This is another financial aid application, but it goes into even greater detail about your family’s finances. It’s usually for institutions that want a more comprehensive picture to award their own institutional aid. Always check the specific requirements of each college you’re applying to.

And then there’s the ongoing hunt for scholarships. This isn’t a one-time sprint; it’s a marathon. Websites like Fastweb, College Board, and Scholarship.com became my regular haunts. But don’t just stick to the big national ones. Look locally! Your high school guidance office, local community organizations, churches, businesses, and even your parents’ employers might offer scholarships that have fewer applicants and better odds. The key is persistence and a willingness to put in the work for those essays and applications.

My journey through student financial aid wasn’t always smooth. There were moments of confusion, frustration, and doubt. I remember one particular instance when I thought I had missed a crucial deadline for a state grant. My stomach dropped, and I felt a wave of panic. I called the financial aid office, my voice shaky, and explained my situation. The person on the other end was incredibly patient, walked me through the process, and helped me realize I still had a small window. It was a vital lesson: always ask for help. The financial aid officers at colleges are there for a reason; they want to see you succeed, and they know the intricacies of the system better than anyone. Don’t be too proud or too scared to reach out.

Another thing I learned was the importance of understanding your financial aid award letter. When a college accepts you and offers aid, they send a letter detailing everything: grants, scholarships, loans, and work-study. It can look like a lot of numbers and jargon. Take the time to read it carefully. Understand what’s "gift aid" (free money) and what’s a loan (money you repay). Compare offers from different schools. Don’t automatically assume the school with the lowest sticker price is the cheapest; sometimes a more expensive school might offer a more generous aid package, making it more affordable in the long run.

For those considering loans, particularly federal ones, make sure you complete entrance counseling before receiving the funds and exit counseling when you leave school. These sessions are designed to educate you about your rights and responsibilities as a borrower, explain interest rates, and outline repayment options. They might seem like just another hoop to jump through, but they are incredibly valuable for understanding the long-term commitment. Knowing your repayment options – like income-driven repayment plans – can provide immense peace of mind.

The biggest takeaway from my personal story is this: don’t let the cost of college deter you from pursuing your dreams. The sticker price you see on a college website is rarely what students actually pay, especially if they qualify for financial aid. There is a whole ecosystem of support designed to make higher education accessible. It requires effort, research, and a bit of bravery to navigate, but it is absolutely worth it.

I graduated with a degree I was proud of, equipped with knowledge and skills that opened doors to opportunities I never thought possible. Yes, I had some student loan debt, but it was manageable, thanks to the careful choices I made and the understanding I gained about repayment. That initial fear I felt at the kitchen table slowly transformed into a deep sense of gratitude and empowerment. The path to college might look like a mountain, but student financial aid provides the climbing gear, the ropes, and the guides to help you reach the summit. My journey proved that with a little persistence and a lot of searching, that impossible fantasy could indeed become a tangible reality. Your journey can too.