You see, I remember standing in my high school counselor’s office, clutching a college brochure. My eyes weren’t drawn to the vibrant campus photos or the exciting course descriptions. No, they zoomed straight to the bottom line: "Tuition and Fees." A knot formed in my stomach. It wasn’t just big; it felt astronomical. My family wasn’t rich, and the idea of my parents taking on that kind of debt for me felt… well, awful.

For a while, I thought my dream was dead. Maybe college wasn’t for me. Maybe I should just get a job, any job. But then, a quiet voice inside me, and a very patient counselor, introduced me to a magic phrase: "Financial Aid."

And let me tell you, that phrase changed everything.

It wasn’t a magic wand, mind you. There was no fairy godmother waving away all my money worries with a flick of her wrist. Instead, it was more like a treasure map, one that led me through a winding path of forms, deadlines, and a few moments of sheer confusion. But at the end of that path? An education I thought I could never afford.

If you’re feeling that same knot in your stomach, that same sense of "how in the world will I pay for this?", then listen up. I’m going to walk you through what I learned, what I did, and what you can do too. Think of this as your friendly guide, your personal storyteller, helping you understand that paying for college is possible, and financial aid is your biggest ally.

The Big Picture: What Even Is Financial Aid?

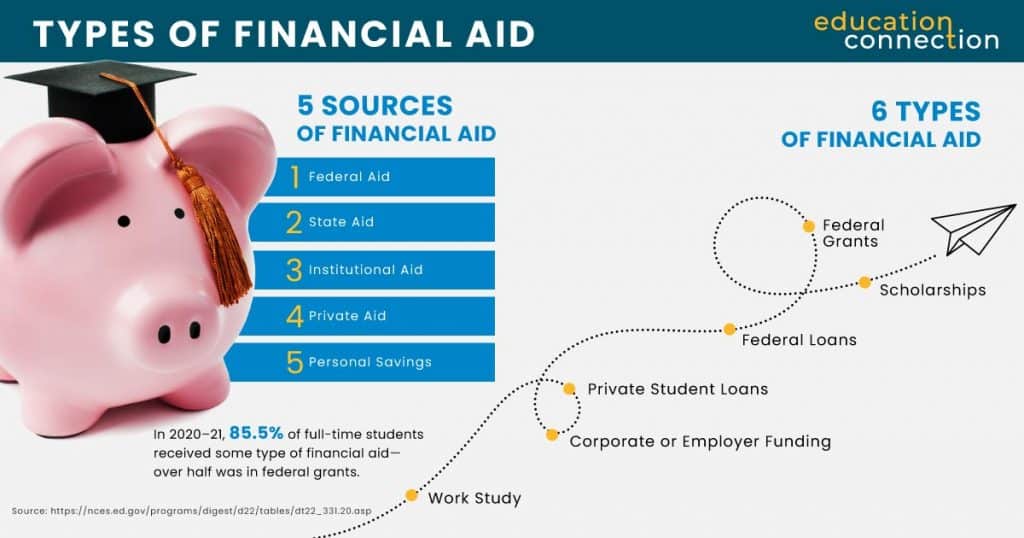

Let’s start simple. Financial aid is just money designed to help students pay for college or career school. It comes from different places: the federal government, state governments, the schools themselves, and private organizations.

Here’s the cool part: not all of this money has to be paid back! That’s right, some of it is essentially free money. That was the first revelation that made my jaw drop. I thought "aid" meant "loan," and "loan" meant "debt." While loans are a part of it, they’re far from the whole story.

So, how do you get your hands on this money? It all starts with one very important form.

My First Big Step: The FAFSA – Don’t Let It Scare You!

The first time I heard "FAFSA," it sounded like some secret government code. It stands for the Free Application for Federal Student Aid. And yes, the "free" part is important. You never have to pay to fill this out.

I remember sitting down with my parents, a stack of tax documents, and a healthy dose of dread. It looked long. It looked complicated. But you know what? It wasn’t nearly as bad as I thought. It asks questions about your family’s income, assets, and household size. All of this helps the government figure out how much they think your family can contribute to your education. This number is called your Expected Family Contribution (EFC), and it’s a big factor in how much aid you’ll get.

My FAFSA Tips:

- File Early: This is probably the most important piece of advice I can give you. The FAFSA opens on October 1st each year. Many types of aid are first-come, first-served. Don’t wait until spring! I learned this the hard way one year, almost missing out on a state grant because I dragged my feet.

- Gather Your Documents: Before you start, get your parents’ (and your own, if you have one) tax returns, W-2s, and bank statements. Having everything ready makes the process much smoother.

- Use the IRS Data Retrieval Tool: This handy tool lets you import your tax information directly from the IRS, saving you time and reducing errors. It was a lifesaver for me!

- Don’t Be Afraid to Ask: If you get stuck, call the FAFSA helpline, or better yet, talk to your high school counselor or the financial aid office at a college you’re interested in. They’ve seen it all and are there to help.

Filling out the FAFSA felt like opening the door to a huge room I didn’t know existed. It’s the key that unlocks almost all federal aid, and often, state and institutional aid too. Don’t skip it!

The "Free Money" Hunt: Grants and Scholarships

This is where the real excitement began for me. The idea of getting money I didn’t have to pay back? That felt like winning the lottery, but with a much better chance of success!

Grants: Often Need-Based, Always Welcome

Grants are usually awarded based on financial need, meaning your FAFSA results play a big part. The most common one you’ll hear about is the Pell Grant. I qualified for a Pell Grant, and let me tell you, that was a huge weight off my shoulders. It covered a significant chunk of my tuition each year.

Beyond the federal government, many states offer their own grants. My state had one that also helped immensely. And sometimes, colleges themselves have grants they award based on your financial situation. The best part? You usually don’t have to do anything extra to apply for these beyond filling out your FAFSA. The system often automatically checks your eligibility.

Scholarships: My Personal Treasure Hunt

Scholarships felt different. They weren’t just about need; they were about me – my grades, my interests, my community involvement, even my weird hobbies. This part felt like a personal quest.

I spent hours, literally hours, looking for scholarships. It wasn’t glamorous, but it paid off. Here’s how I approached it and what I learned:

- Start with Your School’s Financial Aid Office: This is a fantastic first stop. Many colleges have their own scholarships for incoming students, and often, just applying to the school makes you eligible. They also have lists of outside scholarships they know about.

- Look in Your Own Backyard: Don’t overlook local scholarships. My local Rotary Club, my parents’ employers, even a small community foundation in my town offered scholarships. Fewer people apply for these, so your odds might be better! I won a small one from a local business just for writing an essay about my volunteer work. Every bit helps!

- Online Scholarship Databases: Websites like Fastweb, Scholarship.com, and BigFuture by College Board became my best friends. You create a profile, and they match you with scholarships you might be eligible for. Be prepared to fill out a lot of applications, but it’s worth the effort.

- Think Broadly, Apply Widely: Don’t just look for "academic scholarships." There are scholarships for everything:

- Specific Majors: Studying engineering? Nursing? Art? There are scholarships for that.

- Talents: Athletics, music, debate, drama.

- Demographics: First-generation college student, specific ethnic background, even left-handedness (yes, really!).

- Community Service: If you’ve spent time helping others, definitely highlight that.

- Unique Essays: Some scholarships just want a good story or a creative response to a prompt.

I remember applying for one scholarship that asked about my favorite book and why. It wasn’t a huge amount of money, but when that acceptance letter came in, telling me I’d won, it felt like a massive victory. It validated all the time I’d spent searching and writing.

My Scholarship Application Tips:

- Tailor Each Application: Don’t just copy-paste. Read the prompt carefully and make sure your essay or answers directly address what they’re looking for.

- Proofread, Proofread, Proofread: A sloppy application can get tossed immediately. Ask a friend, parent, or teacher to read it over.

- Don’t Disregard Small Scholarships: A $500 scholarship might not sound like much, but a few of those add up quickly! $500 here, $1000 there, and suddenly you’ve got a significant dent in your textbook costs or even a tuition payment.

- Keep a Spreadsheet: It’s easy to lose track of deadlines and what you’ve applied for. I kept a simple spreadsheet with scholarship name, requirements, deadline, and status.

When "Free Money" Isn’t Enough: Understanding Loans

Okay, so I got some grants and a few scholarships. It helped a lot, but it didn’t cover everything. That’s where loans came into the picture. And honestly, this was the part that gave me the most anxiety. The idea of being in debt felt scary.

But I learned that not all loans are created equal, and some are definitely better than others.

Federal Student Loans: Your First Choice

If you need to borrow money, federal student loans should always be your first choice. Why? Because they come with protections and benefits that private loans simply don’t offer.

- Subsidized vs. Unsubsidized: This is important!

- Direct Subsidized Loans: These are for students with demonstrated financial need. The government pays the interest on these loans while you’re in school at least half-time, during your grace period (the six months after you leave school before you start paying), and during deferment periods. This means the loan amount doesn’t grow while you’re studying! I was so relieved when I qualified for these.

- Direct Unsubsidized Loans: These are available to all eligible students, regardless of financial need. The interest starts accumulating immediately, even while you’re in school. You don’t have to pay it until after you graduate, but it does add up.

- Fixed Interest Rates: Federal loans usually have fixed interest rates, meaning they won’t change over the life of the loan. This makes budgeting much easier.

- Income-Driven Repayment Plans: This is a huge benefit. If you graduate and your income isn’t high, you can choose a repayment plan where your monthly payments are based on how much you earn. This can prevent you from defaulting if you hit a rough patch.

- Deferment and Forbearance: If you face financial hardship, you can often pause your payments temporarily.

- Potential for Loan Forgiveness: Certain professions (like public service) or situations can qualify you for federal loan forgiveness programs.

I decided to take out the minimum amount of federal loans I needed each year. It felt like a big decision, but knowing the benefits and protections eased my mind. It was an investment in my future, and I felt I was making a smart choice by sticking with federal options.

Private Student Loans: A Last Resort

Sometimes, even after maxing out federal aid, grants, and scholarships, there’s still a gap. That’s when you might consider private student loans. These loans come from banks, credit unions, and other private lenders.

My strong advice? Tread very, very carefully here.

- Less Favorable Terms: Private loans usually have variable interest rates (meaning they can go up!), fewer borrower protections, and often require a co-signer (like a parent) if you don’t have a strong credit history.

- No Income-Driven Repayment: You won’t find the flexible repayment options that federal loans offer.

- Limited Deferment/Forbearance: Options to pause payments are usually much more restrictive.

I managed to avoid private loans, and I’m so glad I did. If you find yourself in a situation where you think you need them, compare lenders diligently, understand every single term of the loan, and only borrow the absolute minimum you need. Talk to your financial aid office before making any commitments. They can help you understand the implications.

Other Avenues I Explored (and You Might Too!)

Beyond the big three (FAFSA, Grants/Scholarships, Loans), I discovered a few other things that could help or that I saw friends use:

- Work-Study Programs: This is a federal program that allows you to work a part-time job, usually on campus, to help pay for educational expenses. The money you earn doesn’t count against you in future FAFSA calculations. It’s a great way to earn some cash, get experience, and still focus on your studies. I had a friend who worked in the library through work-study, and she loved it.

- Employer Tuition Assistance: If you’re working, or if your parents work for certain companies, check if they offer tuition reimbursement or assistance programs. Many employers will help pay for courses or degrees that relate to your job.

- Payment Plans: Many colleges offer their own payment plans, allowing you to break up your tuition bill into smaller, more manageable monthly installments over the semester. This can be helpful if you have savings but prefer not to pay a lump sum all at once.

My Key Takeaways & Advice for You

Looking back, that initial fear of college costs seems so distant now. I got my degree, and while it wasn’t free, it was affordable thanks to financial aid. Here’s what I want you to remember:

- Start Early, Seriously Early: The earlier you start filling out the FAFSA and hunting for scholarships, the better your chances of getting more aid. Deadlines matter!

- Don’t Be Afraid to Ask for Help: The financial aid office at any college is your best friend. They are literally there to guide you through this. Your high school counselor is also a fantastic resource.

- Apply for Everything: Even if you think you won’t get it, apply. You never know! Those small scholarships add up.

- Read the Fine Print: Whether it’s a scholarship requirement or a loan agreement, understand what you’re signing up for. Knowledge is power, especially with money.

- It’s a Process, Not a One-Time Thing: Financial aid usually needs to be reapplied for every year. Keep those documents organized!

- Don’t Get Scammed: Never pay for FAFSA assistance or scholarship searches. Legitimate resources are free. If something sounds too good to be true, it probably is.

Your Education Awaits

My journey through the world of financial aid taught me a lot. It taught me perseverance, organization, and the value of asking for help. More importantly, it showed me that the dream of higher education doesn’t have to be crushed by the weight of tuition bills.

Financial aid isn’t just about money; it’s about opportunity. It’s about opening doors that might otherwise stay closed. So, take a deep breath. That mountain of money? It’s not as insurmountable as it looks. With a little effort, some smart planning, and the right information, you can find your path to college, just like I did.

Go on, start your own treasure hunt. Your future self will thank you.