Car Insurance: A Comprehensive Guide to Protecting Yourself on the Road

Driving a car offers freedom and convenience, but it also comes with inherent risks. Accidents happen, and the financial consequences can be devastating. Car insurance is your safety net, a contract that protects you from those potential financial burdens. Understanding car insurance is crucial for every driver, allowing you to make informed decisions and secure the right coverage for your needs. This comprehensive guide will walk you through everything you need to know about car insurance, from the basics to advanced considerations.

What is Car Insurance?

At its core, car insurance is a contract between you (the policyholder) and an insurance company. In exchange for regular payments (premiums), the insurance company agrees to cover specific financial losses resulting from car accidents or other covered incidents. These losses can include damage to your vehicle, injuries to yourself or others, and legal liabilities.

Why is Car Insurance Important?

- Legal Requirement: In most countries and states, car insurance is mandatory. Driving without insurance can result in hefty fines, license suspension, or even jail time.

- Financial Protection: Accidents can be incredibly expensive. Without insurance, you could be responsible for paying for vehicle repairs, medical bills, and legal fees out-of-pocket, potentially leading to financial ruin.

- Protection for Others: Car insurance not only protects you but also protects other drivers, passengers, and pedestrians who may be injured in an accident you cause.

- Peace of Mind: Knowing you have car insurance provides peace of mind, allowing you to drive with confidence knowing that you're protected against unexpected events.

Types of Car Insurance Coverage:

Car insurance policies typically consist of several different types of coverage, each designed to protect you in specific situations. Here's a breakdown of the most common types:

-

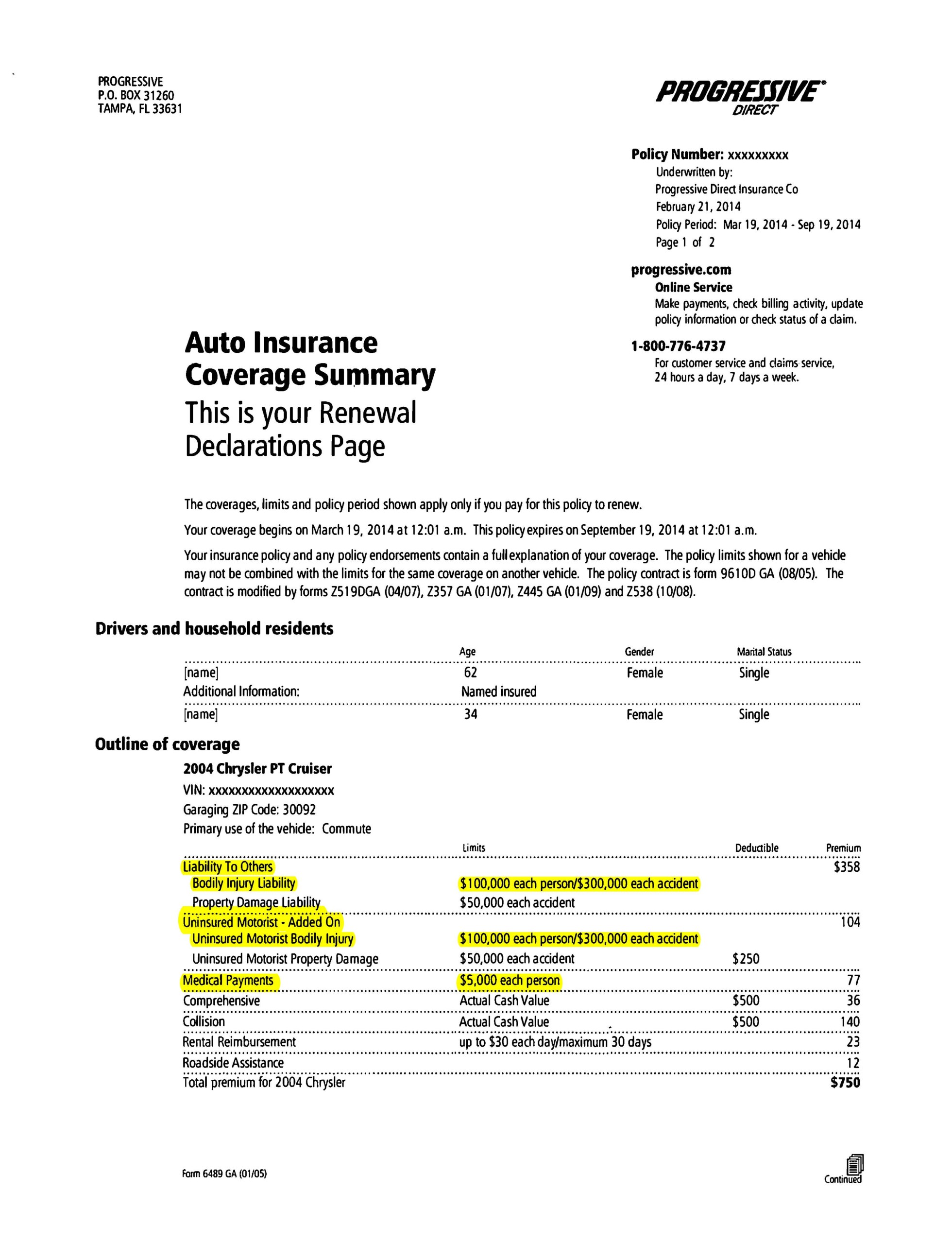

Liability Coverage: This is the most basic and often legally required type of coverage. It protects you if you're at fault in an accident that causes injury or property damage to others.

- Bodily Injury Liability: Covers medical expenses, lost wages, and pain and suffering for people injured in an accident you caused.

- Property Damage Liability: Covers the cost of repairing or replacing another person's vehicle or property damaged in an accident you caused.

Liability coverage is usually expressed as two numbers, such as 50/100/50. The first number (50) represents the coverage limit (in thousands of dollars) for bodily injury to one person. The second number (100) represents the total coverage limit for bodily injury to all people injured in one accident. The third number (50) represents the coverage limit for property damage.

Example: 50/100/50 means $50,000 coverage for one person's injuries, $100,000 total coverage for all injuries, and $50,000 coverage for property damage.

-

Collision Coverage: This covers damage to your vehicle resulting from a collision with another vehicle or object, regardless of who is at fault. It typically has a deductible, which is the amount you pay out-of-pocket before the insurance company covers the rest.

-

Comprehensive Coverage: This covers damage to your vehicle from events other than collisions, such as theft, vandalism, fire, hail, flood, or hitting an animal. Like collision coverage, it usually has a deductible.

-

Uninsured/Underinsured Motorist Coverage: This protects you if you're injured in an accident caused by a driver who doesn't have insurance (uninsured) or doesn't have enough insurance to cover your expenses (underinsured).

- Uninsured Motorist Bodily Injury (UMBI): Covers your medical expenses, lost wages, and pain and suffering if you're injured by an uninsured driver.

- Uninsured Motorist Property Damage (UMPD): Covers damage to your vehicle if it's damaged by an uninsured driver (this may not be available in all states).

- Underinsured Motorist Bodily Injury (UIMBI): Covers the difference between your damages and the at-fault driver's insufficient insurance coverage.

-

Personal Injury Protection (PIP): In some states, PIP coverage is mandatory. It covers your medical expenses and lost wages, regardless of who is at fault in an accident. It can also cover expenses for your passengers.

-

Medical Payments Coverage (MedPay): Similar to PIP, MedPay covers your medical expenses and those of your passengers, regardless of fault. However, it typically has lower coverage limits than PIP.

Factors Affecting Car Insurance Rates:

Insurance companies use a variety of factors to determine your car insurance rates. Understanding these factors can help you find ways to lower your premiums.

- Driving Record: A clean driving record with no accidents or traffic violations will result in lower rates. Accidents, speeding tickets, and other moving violations will increase your rates.

- Age: Younger drivers, particularly those under 25, typically pay higher rates due to their inexperience and higher risk of accidents. Rates generally decrease with age.

- Gender: Statistically, male drivers tend to be involved in more accidents than female drivers, so they may pay slightly higher rates, especially when they are younger.

- Location: Where you live can significantly impact your rates. Urban areas with higher traffic density and crime rates tend to have higher insurance costs.

- Vehicle Type: The make and model of your car affect your rates. Expensive cars, sports cars, and cars that are frequently stolen tend to have higher insurance costs. Safety features can lower insurance costs.

- Credit Score: In many states, insurance companies use credit scores to assess risk. A good credit score can result in lower rates, while a poor credit score can lead to higher rates.

- Coverage Limits and Deductibles: Higher coverage limits and lower deductibles will result in higher premiums. Conversely, lower coverage limits and higher deductibles will lower your premiums.

- Annual Mileage: The more you drive, the higher your risk of being involved in an accident, so higher annual mileage can increase your rates.

- Marital Status: Married drivers statistically tend to be more responsible drivers, which can result in lower rates compared to single drivers.

How to Choose the Right Car Insurance Policy:

Choosing the right car insurance policy can be overwhelming, but here are some steps to guide you through the process:

- Determine Your Needs: Assess your individual needs and risk tolerance. Consider factors like your driving habits, the value of your car, and your financial situation.

- Research Different Insurers: Compare quotes from multiple insurance companies. Online comparison tools can help you quickly get quotes from several insurers.

- Understand Coverage Options: Familiarize yourself with the different types of coverage and their benefits. Make sure you have adequate liability coverage to protect yourself from potential lawsuits.

- Consider Deductibles: Choose deductibles that you can comfortably afford to pay out-of-pocket in the event of an accident. Remember that higher deductibles usually mean lower premiums.

- Read the Fine Print: Carefully review the policy terms and conditions to understand what is covered and what is excluded. Pay attention to any exclusions or limitations.

- Ask Questions: Don't hesitate to ask the insurance agent or company any questions you have about the policy.

- Consider Bundling: Many insurance companies offer discounts if you bundle your car insurance with other policies, such as homeowners or renters insurance.

- Review Your Policy Regularly: Your insurance needs may change over time. Review your policy annually or when you experience a significant life event, such as moving or buying a new car.

Tips for Lowering Your Car Insurance Rates:

- Shop Around: Compare quotes from multiple insurers to find the best rates.

- Increase Your Deductibles: Higher deductibles can significantly lower your premiums.

- Maintain a Good Driving Record: Avoid accidents and traffic violations.

- Improve Your Credit Score: A good credit score can result in lower rates in many states.

- Take a Defensive Driving Course: Some insurers offer discounts for completing a defensive driving course.

- Bundle Your Insurance Policies: Bundle your car insurance with other policies to get a discount.

- Ask About Discounts: Inquire about available discounts, such as discounts for students, seniors, or military personnel.

- Drive a Safe Car: Cars with good safety ratings and features may qualify for lower insurance rates.

- Reduce Your Mileage: If you drive less, you may be able to lower your rates.

Filing a Car Insurance Claim:

If you're involved in an accident, here's how to file a car insurance claim:

- Exchange Information: Exchange contact and insurance information with the other driver(s) involved.

- Document the Scene: Take photos or videos of the accident scene, including vehicle damage and any injuries.

- Report the Accident: Report the accident to your insurance company as soon as possible.

- Cooperate with the Investigation: Cooperate with the insurance company's investigation and provide any requested information.

- Get an Estimate for Repairs: Get an estimate for repairing your vehicle from a reputable mechanic.

- Review the Settlement Offer: Carefully review the insurance company's settlement offer and negotiate if necessary.

Conclusion:

Car insurance is an essential investment for every driver. It provides crucial financial protection in the event of an accident and peace of mind knowing that you're covered. By understanding the different types of coverage, factors affecting rates, and how to choose the right policy, you can make informed decisions and secure the best possible protection for your needs. Remember to shop around, compare quotes, and review your policy regularly to ensure that you have adequate coverage at a competitive price. Driving safely and maintaining a good driving record are also essential for keeping your insurance rates low.