My heart sank. Tuition fees, living expenses, textbooks… it all added up to a mountain of money I simply didn’t have. For a moment, I thought my dream was over before it even began. But I’m not one to give up easily. I decided I would tackle this financial puzzle with the same determination I’d bring to my studies. And let me tell you, what I discovered along the way changed everything.

If you’re staring down that same daunting financial mountain, take a deep breath. You’re not alone, and there are absolutely ways to make your university dreams a reality. Let me walk you through what I learned on my own journey.

1. Scholarships: My First Hunting Ground for "Free Money"

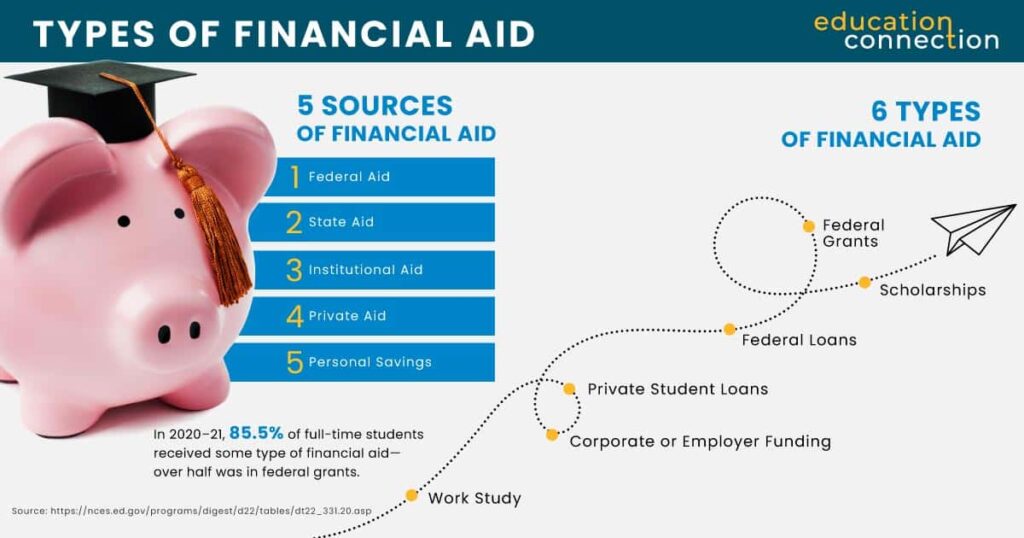

This was my initial focus, and honestly, where I spent most of my early research energy. Scholarships are like academic lottery tickets – money given to you based on all sorts of criteria, and you don’t have to pay it back. The key is to find the ones that fit you.

- Merit-Based Scholarships: These are often awarded for academic excellence, like high grades or impressive test scores. My university offered some based on my GPA, and I applied for every single one.

- Talent-Based Scholarships: Are you a fantastic musician, a star athlete, or a gifted artist? Many institutions and organizations offer scholarships for specific talents. I had a friend who got a partial scholarship just for being an incredible debater!

- Niche & Community Scholarships: This is where it gets really interesting. I found scholarships for students from specific hometowns, for those pursuing particular fields (like nursing or engineering), for volunteering, or even for things like being left-handed! Don’t underestimate local community groups, businesses, and even your high school alumni associations. They often have funds dedicated to students from their area.

My Tip: Don’t just look at big national scholarships. Dig deep! Check your university’s financial aid page, local library, community foundations, and online scholarship search engines. The more you apply for, the better your chances. Each small scholarship adds up!

2. Grants: The Other Kind of "Free Money" You Don’t Repay

Next up were grants, and oh, how I loved the sound of that word: "free money" that usually doesn’t need to be paid back. While scholarships often focus on merit, grants are typically awarded based on financial need.

- Federal/Government Grants: In many countries, the government offers grants to students who demonstrate a significant financial need. For instance, in the US, the Pell Grant is a well-known example. I filled out my FAFSA (Free Application for Federal Student Aid) meticulously, as this form is the gateway to most federal and state aid.

- Institutional Grants: Many universities have their own grant programs, often for students who meet certain financial criteria. Again, completing your financial aid applications thoroughly is crucial.

- Private Grants: Sometimes, non-profit organizations or foundations offer grants. These might be harder to find but are definitely worth the search if you meet their specific requirements.

My Tip: The FAFSA (or equivalent government financial aid application in your country) is your absolute best friend here. Fill it out accurately and on time, every single year you plan to attend university. It opens doors to so much assistance.

3. Student Loans: Borrowing for Your Future (Wisely!)

Now, this was the part that made me a little nervous, and rightly so. Loans mean borrowing money that you do have to pay back, usually with interest. But for many, including me, they’re a necessary bridge to higher education. The trick is to be smart about it.

- Federal Student Loans: These are often your best bet if available in your country. In the US, for example, federal loans come with benefits like fixed interest rates, options for income-driven repayment plans, and opportunities for deferment if you face hardship. Some even offer subsidized interest, meaning the government pays the interest while you’re in school. I prioritized these loans because of their favorable terms.

- Private Student Loans: These come from banks or private lenders. I tried to avoid these as much as possible because they often have higher, variable interest rates and fewer borrower protections. If you do consider a private loan, compare offers carefully and understand all the terms before signing anything.

My Tip: Only borrow what you absolutely need. Create a budget, factor in all your other funding, and then see what gap remains. Every dollar you borrow now means more debt later. And always understand the interest rates and repayment terms before you commit.

4. Work-Study Programs: Earning While You Learn

I remember thinking, "If I’m going to be on campus all day, why not earn some money on campus?" Work-study programs are a fantastic option, often integrated into your financial aid package. They allow you to work part-time, usually in a campus job (like in the library, a departmental office, or even as a research assistant), to help cover your educational expenses.

The beauty of work-study is that these jobs are designed with students in mind: flexible hours, often conveniently located, and sometimes even related to your field of study. I worked a few hours a week in the university’s communications office, which not only gave me some spending money but also valuable experience.

My Tip: Check your financial aid award letter to see if you’ve been offered work-study. If not, ask your financial aid office if there are other on-campus job opportunities available.

5. Beyond the Obvious: Creative Solutions

As I delved deeper, I realized funding wasn’t just about big programs; it was also about being resourceful.

- Personal Savings & Family Contributions: For some, this is a starting point. If you or your family have savings set aside for education, it’s a huge advantage. Even small contributions can significantly reduce the amount you need to borrow.

- Part-Time Jobs (Outside Work-Study): Many students work off-campus jobs during their studies. While it requires careful time management to balance work and academics, it can provide crucial income for living expenses, textbooks, or just a little bit of fun.

- Crowdfunding: This is a newer, more modern approach. Platforms allow you to share your story and solicit donations from friends, family, and even strangers who believe in your educational journey. I saw a few classmates successfully raise funds this way for specific project costs or even general tuition.

- Employer Tuition Reimbursement: If you’re already working, check if your employer offers tuition reimbursement programs. Many companies are willing to pay for part or all of your university education, especially if it relates to your job.

My Golden Rules for Your Funding Journey

Looking back, if I could give my younger self a pep talk, these would be my core messages:

- Start Early: The earlier you begin researching and applying, the more options you’ll uncover.

- Research Everything: Don’t assume anything. Read every page on your university’s financial aid site, explore national databases, and ask questions.

- Apply Relentlessly: Every scholarship, every grant, every work-study option – apply for them all! Even if you think your chances are slim, you never know.

- Understand the Fine Print: Especially with loans, know what you’re signing up for. Interest rates, repayment schedules, deferment options – understand it all.

- Budget Wisely: Once you have your funding, create a budget and stick to it. Knowing where your money goes helps you stretch it further.

- Don’t Give Up: There will be moments of frustration, but every "no" brings you closer to a "yes." Persistence is key.

The path to university funding isn’t always straight or easy, but it is absolutely navigable. My journey taught me that with a bit of elbow grease, smart planning, and a refusal to quit, that golden ticket to higher education can indeed be yours. So, go forth, research, apply, and make your university dreams come true! Your future self will thank you for it.